You Just Moved Somewhere New and You Don’t Know Anyone..

Due to the unfavorable job market, it is very likely that most college graduates will have to relocate to get a full time job in their field of study. I personally had to uproot myself from Minneapolis, MN to Green Bay, WI – granted I went to college on basically the MN/WI border, but it was still an adjustment (and believe me, the Vikings-Packer thing gets old fast). Anyways, I had never been to the Green Bay area except for my job interview and to find my new apartment. Everything was new to me and there was at most two people I knew from college. Heck, I couldn’t even say towns like Shawano, Bonduel, and Weyauwega correctly. I felt alone and homesick. So what did I do? I got out of my comfort zone, researched things to do, and got involved in some way or another.

So if you have just moved somewhere completely new as well, here are some ideas for getting out there and creating new relationships:

- Check out your local community center (and even surrounding areas) for classes to take and to learn about key community events coming up.

- Join a nearby gym or YMCA. Take advantage of those spinning or Zumba classes.

- If you’re in to playing instruments, see if there is a city band nearby.

- Lots of bars and bowling alleys and have leagues throughout the year you can sign up with.

- Try a local 5K or triathlon. Even better, find one of those free training practices associated with said 5K or triathlon.

- Go to a local coffee shop. You can count on them to have postings of cool events going on.

- Join a church associated with your faith.

- Get volunteering! Try the local humane society, food shelf, red cross, etc.

- Join the local Jaycee chapter.

- Find the nearest Young Professionals chapter (seriously just Google “young professionals near…”)

The important thing is to put yourself out there and to do these activities repeatedly. You will become a familiar face and these new adventures will spark new friendships and relationships.

Know Your Net Worth

Last week at work, a Vanguard financial advisor came to host a seminar: “Reduce Debt, Build Wealth, and Get Ahead.” The seminar had a lot of great advice and expertise, even though what it really did was confirm the financial activities I was already doing. BUT! I wanted to share some things since not everyone gets to have a free financial seminar at work and to help avoid the “I wish I knew that when I was younger..” line. You are younger, you have the opportunity to build healthy finances!

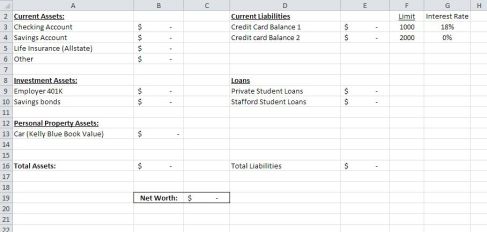

First and foremost, you need to know your net worth (hence the blog post title). You can simply do this by creating an Excel spreadsheet. Below is an image of a mock spreadsheet that is mirrored after my own with some things deleted and all dollar amounts at zero. The important thing is knowing your assets versus your liabilities and ultimately what your net worth is. So my total assets are summed together and my total liabilities are summed together. The net worth box is simply subtracting the liabilities from the assets – ta da! No fancy Excel formulas needed!

*Click on photo to see it bigger

Once you have an idea of your net worth, you can begin to dig deeper to see where your money goes every month and how much you actually keep. Maybe there are things that you are doing that are costing you more than you realize? Look at your debit card and credit card transactions and see what you’re spending your money on.

Currently my net worth is a little on the negative side due to those wonderful student loans, but it just gives me the drive to make that number positive. I know where I stand and I know I want to improve.

You should also check out Vanguard’s tips for getting ahead financially: www.vanguard.com/getahead

You do not need a log in to access the information in the “Get Ahead” section.

I would also follow Vanguard’s Twitter account for daily tips: @Vanguard_Group

And I know I have already shared this in a previous post regarding books to read, but I highly recommend reading Smart Women Finish Rich and Smart Couples Finish Rich by David Bach. Knowledge is power!

So what are you waiting for? Go figure out your net worth!

Post Grad Advice Mini Tip: Keep that $5 bill!

Lately, if a $5 bill comes my way, I put it an envelope in one my drawers. Sounds silly but hey I’ve already racked up $30 in “extra cash” since starting this a month ago.

How did I pick $5? Well, $1 seemed too little and $10 seemed too noticeable – $5 is just right.

And you’re likely to use that $5 on something quick and frivolous, whereas you could be compounding those $5 bills in to something greater.

So whenever a $5 bill crosses my path when I’ve paid in cash for something, I store it away in a place in my apartment I don’t go to often so I won’t be tempted to use the money.

Yes, I do have a checking account, savings, account, and emergency credit card, but what if something were to happen and I needed money this instant? What if my identity was stolen? What if I had to pay a huge expense? Yes the $5 is not accruing interest in my security lined envelope, but it is an additional safety net.

Think of it as finding a $5 bill in your jacket pocket you forgot you put in there last winter – it feels great rediscovering you’re own money! This $5 idea has a similar feeling and someday you’ll be glad you started it. I can’t wait to see what my little $5 stash will grow to!

Thrifty Christmas Tips:

1. Keep those gift bags you receive! As long as their in good shape, you can re-use them next year. Just make sure that any “To: From:” tags are removed or covered up.

2. Still need gift tags? Head to your local dollar store! You can get 50-100 sticker gift tags for a $1 and keep using them years to come!

3. After Christmas clearance! Stock up on wrapping paper, shatterproof ornaments, lights, etc. Set aside an amount you’re willing to spend for next year’s decor or gifting. But also keep in mind the storage constraints of your apartment. Any other holiday seasonal product will also be on clearance the day after Christmas. It depends on the retailer, but the after Christmas clearance is usually 50-75% off. The only caveat is once it’s gone it’s gone. That store will not be getting any more of that product in.

Post Grad Advice Mini Tip: Weddings Savings

It seems like all you ever see on your Facebook news feed are statuses about a new engagement or planning an upcoming wedding.

And chances are you are a bridesmaid, maid of honor, the bride to be, or someone who will likely become engaged in the near future.

Well, weddings are darn expensive and you’re already in college debt, so why not save an expense and win a bridal gown or five bridesmaid dresses from David’s Bridal?

Every month you can enter their contest for a chance to win a bridal gown or five bridesmaid dresses.

All you have to do is create profile – it’s that easy! They do ask for a wedding date, but if you don’t have a wedding date, just make one up that is a few years from now. It’s not like that input field is set in stone.

Another tip: David’s Bridal has their $99 gown sale every so often with different dresses chosen. Keep an eye out for this sale and the incredible savings!

DIY designer looks for less

If you love DIY projects but don’t have the money to spend on designer pieces, check out P.S. I Made This.

Blogger Erica Domesek creates visually appealing tutorials to compliment her motto of: “I see it. I like it. I make it.”

When you’re trying to make it in the real world but living on a small budget, you need a DIY designer blog like this.

This DIY designer concept goes along with my motto: “Fake it until you make it.”

Will you look fabulous? Yes.

Will you look trend right and relevant? Yes.

Will you have spent lots of money to impress others? No.

I find it awe-inspiring that she has created a successful business from doing something she loves and sharing it with others. So go check out Erica’s tumblr blog, watch her videos, possibly buy her book, but most importantly create something and have fun!

Google Alerts are your friend

I learned the importance of Google Alerts in my marketing management class in college and have been using them ever since.

Why do you need to use them? What do you need to use them for?

Simple: To keep you aware of your employer and industry.

Simply create a Google Alert to scan the news, blogs, and websites for your employer’s name so that you are abreast of what’s going on in your business. Also create one for the industry that you work in. You need to be aware of the macro and micro environment and how it can influence your business.

Google Alerts will make you proactive and well informed. Use them to your advantage.

For more information on Google Alerts and how to set them up: http://www.google.com/alerts